The future is uncertain; however, at times one gets a glimpse of possibilities that may soon have enormous impact on underwriting. In addition, there are several developments affecting underwriting and the life industry today, especially concerning the regulatory environment and the use of data and algorithmic solutions in life underwriting. All of this and more was presented and discussed at the recent Association of Home Office Underwriters (AHOU) meeting. This year's AHOU was the largest on record with nearly 1000 attendees. Participants included underwriting leadership fr...

Last month we featured guest Bobby Samuelson and Windsor's Marc Schwartz in a conversation about "The World of Life Insurance – Version 2023." In the course of that discussion, Marc and Bobby both touched on the recent introduction of Variable UL products based on the success of Registered Index Accounts, with Bobby saying "I'm excited to see how this corner of the market develops over time. It's nothing but positive for distributors, agents and consumers." Today's blog, originally a podcast, brings together Marc, Jeff Driscoll of NFP, and moderator Kristin Williams, NFP's Senior V...

In May of 2019 we posted a conversation with Bobby Samuelson to Windsor's website that we ambitiously called, The World of Indexed Universal Life. That blog has led all Windsor blogs in popularity right up to today. Indexed UL has expanded beyond the boundaries of those early days to become a formidable product with wide appeal to financial professionals and to insurance-buying consumers. And, because of its rapid growth in the marketplace, it has more than once caught the eye of insurance regulators. Today, Bobby Samuelson graciously joins us again for a conversation wi...

Much change has occurred in underwriting and the underwriting process during the past couple of years. A great deal of this has centered on how to make life insurance more accessible for prospects who are demanding a faster, better and less invasive application process. While at the same time, carriers attempt to balance these changes with predictable mortality results. To understand what's happening in the underwriting industry and what the future may hold, we engaged three high profile underwriting industry experts and thought leaders to answer a few questions about their views o...

In June, 2019, Windsor's Marty Flaxman wrote one of our most popular blogs, "Today There's a $22 Million Lifetime Gift Tax Exclusion - Your Clients Can Use It or Lose It." We asked Marty to revisit this post as we approach 2023, with only a few years left for you and your clients to take advantage of this singular opportunity. The numbers have changed, mostly favorably. But more important, time is running out. A successful sale typically has three common elements: It solves an important problem. The solution itself is time-limited, meaning that if y...

"The most powerful person in the world is the storyteller. The storyteller sets the vision, values and agenda of an entire generation . . . ." - Steve Jobs Gordon Richardson has life insurance in his blood. He is a second-generation life insurance producer, learning from his father who has been a Windsor friend for decades. For Gordon, life insurance has always been a key part of what he offers to clients and is integral to his business. As "Life Insurance Awareness Month 2022" winds down, we asked Gordon to share a story about how practicing his profession provided security ...

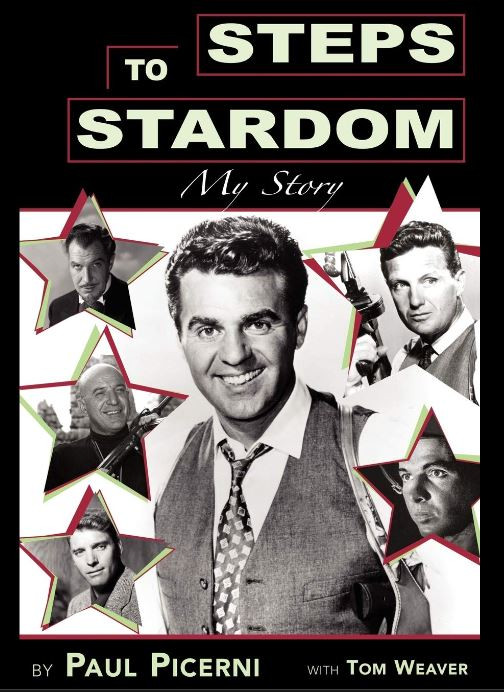

— Your clients are worried. Life insurance can help. "The actor Paul Picerni was my grandfather," begins Windsor's Dan Picerni. "I called him Papa. He appeared in over five-hundred films and television productions. With eight kids he couldn't afford not to work when the downtimes came, so he filled the lull by selling life insurance. In the 1950s he bought three nice size life insurance policies to help take care of his family in the event of his death. Fortunately, the income replacement was never needed, and he lived until 2012. He continued p...

Early in 2022, Windsor began to see a new growing focus on cash accumulation sales. While using life insurance to provide funds for future cash flow obligations, be it college tuition or supplemental retirement income, is nothing new, something had changed. In 2020, in an "under the radar" rule change, the §7702 interest rate — which sets limits on premiums, cash values and death benefits for life insurance policies to qualify as "life insurance contracts" for Federal income tax purposes — was revised. The rates, which were last set in 1984, were 4% for the Cash Value Accumulation ...

After a two-year hiatus, the Association of Home Office Underwriters (AHOU) was held recently in person with over 900 attendees present. Meeting participants included underwriting leadership from all major life carriers, reinsurance companies, exam/lab vendors, industry data/information providers and several technology companies among others. It was terrific to be back in person at this meeting, networking with industry pros and peers, and gaining important insight and perspective on the current state of life underwriting. Over the past few years and accelerated by the pandemic, th...

"Complicated [permanent life insurance] products eat away at the purchasing power of your premium. In most situations, your financial planning will be better served by buying term life insurance and then investing outside of the insurance contract.1 "Do not let anybody tell you that your life insurance policy is a good way to build extra savings. Fall for that and you will end up wasting thousands of dollars over the life of the policy.2 As life insurance professionals, we know that sentiments like those above are nothing new. And in response, Windsor's recent Blog — Life Insurance and R...

By accepting you will be accessing a service provided by a third-party external to https://windsorinsurance.cloudaccess.host/